Welcome to our comprehensive Exness review, where we delve into the history, operations, and regulatory standing of one of the leading players in the global forex brokerage industry. This section aims to provide you with an insightful look into what makes Exness a trusted name in forex trading.

Company Background

Exness was established in 2008 with the vision of offering transparent and reliable brokerage services to traders around the world. Since its inception, Exness has seen substantial growth, not only in terms of trading volume but also in expanding its range of financial services. Significant milestones in the company’s history include the introduction of cutting-edge technology for seamless trading, the expansion into various global markets, and achieving record-breaking trading volumes that underscore its credibility and reliability in the forex industry. This growth trajectory highlights Exness’s commitment to providing exemplary trading conditions and innovative solutions to its clients.

Regulatory Information

Exness takes regulatory compliance seriously, which is pivotal in the forex trading industry for ensuring client security and maintaining operational integrity. Exness is regulated by several key financial authorities which ensure that the broker adheres to stringent standards:

- Cyprus Securities and Exchange Commission (CySEC): Exness is licensed and regulated by CySEC, allowing it to operate within the EU and other jurisdictions under strict regulatory guidelines.

- Financial Conduct Authority (FCA): For operations in the UK, Exness complies with the FCA, known for its rigorous regulatory standards and commitment to protecting traders.

- Other Jurisdictions: Beyond CySEC and the FCA, Exness is registered with and regulated by multiple financial authorities across different countries, enhancing its global reach and reliability.

These regulations ensure that Exness operates under fair trading practices and provides a secure trading environment for its clients. The adherence to international regulatory standards is a testament to Exness’s dedication to transparency and ethical business practices.

This overview sets the foundation for understanding how Exness stands out in the competitive forex market. The following sections of our Exness broker review will further explore the specific services, trading platforms, and educational resources that Exness offers to its diverse clientele.

Trading Platforms Review

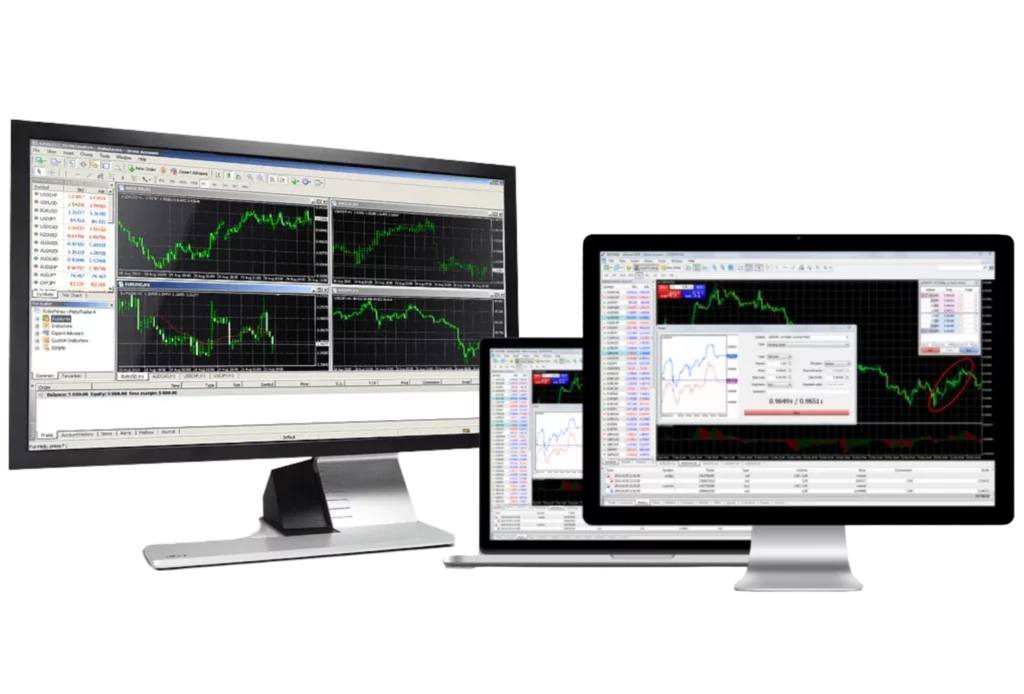

Exness offers a selection of high-performance trading platforms to cater to various trading needs and styles. From the widely acclaimed MetaTrader 4 and MetaTrader 5 platforms to the versatile Web Terminal, each platform is equipped with unique features and benefits designed to enhance your trading experience. Here’s a detailed review of each platform available at Exness:

MetaTrader 4 (MT4)

Features and Benefits:

- User-Friendly Interface: MT4 is renowned for its intuitive interface, making it ideal for both beginners and experienced traders.

- Advanced Charting Tools: Provides a vast array of charting capabilities and technical indicators that allow for detailed market analysis.

- Automated Trading: Supports the use of Expert Advisors (EAs), enabling traders to automate their trading strategies and take advantage of algorithmic trading.

- Customization: Offers extensive customization options for charts and the trading environment, allowing traders to tailor the platform to their personal preferences and strategies.

Why It’s Suited for Exness Users:

- Reliability: Exness enhances MT4 with superior execution speeds and stability, ensuring trades are processed without delays.

- Flexibility: With no minimum deposit requirements for standard accounts, MT4 at Exness is accessible to traders of all levels, providing them with the tools needed to start or continue trading effectively.

- Support and Integration: Exness provides full support for MT4 across all devices, including PC, Mac, iOS, and Android, ensuring traders can access their accounts and trade from anywhere at any time.

MetaTrader 5 (MT5)

Advanced Features Compared to MT4:

- More Timeframes and Technical Indicators: MT5 includes more built-in technical indicators, graphical tools, and timeframes, offering traders greater precision in their market analysis.

- Economic Calendar: Integrated directly into the platform, allowing traders to access important financial events and news without leaving the platform.

- Multi-Asset Trading: Enables trading across different markets, including forex, stocks, and commodities, all from a single platform.

- Enhanced Order Management: Offers additional order types and improved pending order options, giving professional traders more control over their trading strategies.

Advantages for Professional Traders:

- Advanced Trading Systems: MT5 supports more advanced trading operations, including larger numbers of pending orders and allows traders to develop, test, and apply Expert Advisors (EAs) and technical indicators with greater complexity.

- Improved Strategy Tester: For back-testing EAs with real historical data, providing insights into the robustness of automated strategies.

- Depth of Market (DOM): Displays bids and offers for a financial instrument at different prices, helping traders understand market dynamics in greater detail.

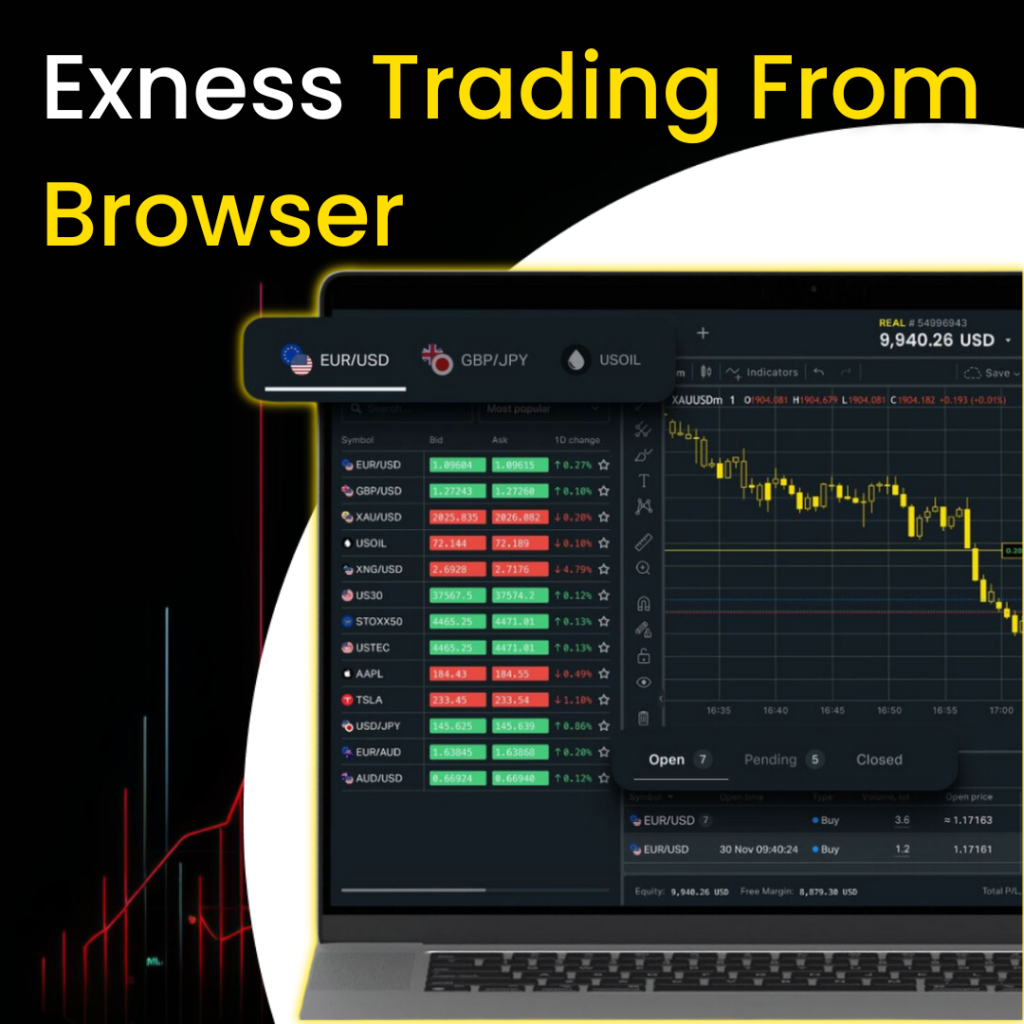

Web Terminal

Accessibility Features and Benefits:

- No Downloads Required: The Exness Web Terminal can be accessed directly through a web browser, eliminating the need for any software installation.

- Compatibility: Works seamlessly across different operating systems and devices, ensuring that traders can access their accounts and respond to market movements promptly no matter where they are.

- User-Friendly: Despite being a web-based platform, it maintains a high level of functionality and includes most of the advanced features found in desktop applications.

Benefits for Traders on the Go:

- Flexibility: Perfect for traders who travel or those who do not wish to download software, providing a flexible trading solution.

- Real-Time Trading: Offers real-time data and execution speeds that are comparable to desktop applications, ensuring that trading decisions can be executed without delay.

- Secure Trading: Maintains robust security measures to protect trader data and transactions, even when accessed over public or less secure internet connections.

Each trading platform provided by Exness is designed to meet the diverse needs of the global trading community, whether you’re looking for simplicity and ease of use, advanced trading features, or flexible access on the move.

Account Types Overview at Exness

Exness caters to a diverse range of traders by offering various account types, each designed to meet specific trading needs and strategies. Whether you’re a novice or a seasoned trader, there’s an account type at Exness that aligns with your trading goals and experience level. Here’s a detailed overview:

Standard Accounts

Features:

- No Minimum Deposit Requirement: Makes it accessible for all traders, allowing you to start trading with any amount.

- Flexible Leverage: Up to 1:2000, giving traders the freedom to choose their risk level and trading style.

- Competitive Spreads: Offers tight spreads starting from just 0.3 pips, which can reduce trading costs significantly.

Who They Are Best Suited For:

- Beginner Traders: The user-friendly features and conditions of the Standard accounts make them ideal for new entrants into forex trading who might be learning the ropes.

- Casual Traders: Those who trade occasionally will find Standard accounts flexible and accommodating, especially with no minimum deposit.

- Cost-Conscious Traders: With competitive spreads and no hidden commissions, these accounts are also well-suited for traders looking to maximize their trading profitability without high costs.

Professional Accounts

Pro Account:

- Minimum Deposit: $200, providing professional trading conditions.

- Commission-Free Trading: Offers the advantage of trading without any commissions on trades, lowering transaction costs.

- Lower Spreads: Features even tighter spreads starting from 0.1 pips for efficiently managing trading costs.

Zero Spread Account:

- Minimum Deposit: $200.

- Near-Zero Spreads: As the name suggests, this account offers spreads from 0 pips, appealing to scalpers and high-volume traders.

- Commission: There is a commission per lot traded, which compensates for the lower spreads.

Raw Spread Account:

- Minimum Deposit: $200.

- Raw Market Spreads: Provides access to raw spreads received directly from liquidity providers, which can be as low as 0.0 pips.

- Commission Charge: Includes a commission charge that’s typical for raw spread accounts, making it suitable for expert traders who require precise execution for large volume trades.

Who They Are Best Suited For:

- Experienced Traders: Professional accounts are tailored for seasoned traders who need advanced features and the best possible trading conditions.

- High-Volume Traders: Those who trade large volumes will benefit from the lower spreads and specialized conditions of these accounts.

- Scalpers and Day Traders: The Zero Spread and Raw Spread accounts are particularly attractive to traders who operate on tight margins and fast execution.

Demo Account

Importance:

- Risk-Free Environment: Allows beginners to practice trading without risking real money, providing a safe space to learn about market conditions.

- Strategy Testing: More experienced traders can use demo accounts to test new strategies, tools, or ideas before applying them in real conditions.

- Platform Familiarization: New users can also familiarize themselves with the trading platform’s features and functions without any financial commitment.

Who It’s Best Suited For:

- New Traders: Those just starting out can gain confidence and experience without the pressure of losing actual capital.

- Strategy Developers: Traders looking to develop or refine trading strategies will find the real-market conditions simulated in the demo account invaluable.

Each account type at Exness is structured to provide specific benefits and features, making it easier for traders to select the one that best fits their trading style and financial goals. Whether opting for the flexibility of Standard accounts, the enhanced conditions of Professional accounts, or the educational benefits of a Demo account, Exness ensures every trader’s needs are met.

Market Instruments at Exness

Exness provides an extensive range of trading instruments across multiple asset classes, ensuring traders have a wide array of options to diversify their portfolios and maximize their trading opportunities.

Forex

- Range of Currency Pairs Available: Exness offers a comprehensive selection of currency pairs, including all major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as a variety of minor and exotic pairs. This breadth of forex pairs allows traders to capitalize on global economic events and market fluctuations.

Cryptocurrencies

- Options Available: Traders can engage with the dynamic cryptocurrency market through Exness with options including Bitcoin, Ethereum, Litecoin, and Ripple. These digital assets are becoming increasingly popular due to their volatility and market growth potential.

- Trading Features: Cryptocurrency trading at Exness is available 24/7, offering high liquidity and the ability to trade both long and short positions, which is an advantage in the fast-moving crypto markets.

Metals and Other Commodities

- Types of Commodities and Metals Offered for Trading: Exness traders have access to a variety of precious metals such as gold, silver, and platinum. These assets are traditionally valued by investors during times of economic uncertainty as a safe haven. Additionally, Exness offers trading in energy commodities like oil and natural gas, which are staples in commodity trading markets.

Educational Resources

Learning Tools

- Webinars, E-books, and Educational Articles: Exness places a strong emphasis on trader education and provides a wealth of learning tools. These include live webinars hosted by market experts, comprehensive e-books covering both basic and advanced trading strategies, and regularly updated educational articles that help traders stay informed about market trends and trading techniques.

Trading Tools

- Analytical Tools and Calculators: To assist traders in making informed decisions, Exness offers advanced trading tools. These include technical analysis tools, economic calendars, pip calculators, and profit calculators. These resources are essential for planning and executing trades effectively, allowing traders to analyze potential profit scenarios and manage risk appropriately.

Customer Support

Contact Options

- Variety of Contact Methods: Exness understands the importance of robust support in trading. Traders can reach out to the customer support team via multiple channels including live chat, email, and phone. This ensures that traders can get assistance whenever needed, regardless of their geographic location.

Customer Service Quality

- Testimonials and User Feedback: The quality of Exness’s customer service is highly rated by its users. Traders often commend the quick response times, the professionalism of the support staff, and the effectiveness of the solutions provided. Testimonials frequently highlight the personalized attention and expert advice that the support team offers, enhancing the overall trading experience at Exness.

This comprehensive suite of market instruments, educational resources, and dedicated customer support makes Exness a top choice for traders looking for a reliable and supportive trading environment. Whether you are a seasoned trader or just starting out, Exness provides all the tools and support needed to navigate the complex world of forex and commodity trading.

Security Features at Exness

Safety Protocols

Exness is committed to ensuring the highest standards of security for user data and funds:

- Data Encryption: All data transmitted between clients and servers is encrypted using advanced cryptographic algorithms to prevent unauthorized access or interception.

- Segregated Accounts: Client funds are kept in segregated accounts with top-tier banks, ensuring they are not used for any other purposes such as company operations.

- Regular Audits: Exness undergoes regular audits by independent third parties to ensure compliance with financial regulations and to maintain transparency in its financial dealings.

Two-Factor Authentication (2FA)

- Importance: 2FA adds an additional layer of security to your trading accounts by requiring not only a password and username but also something that only the user has on them, like a mobile device. This significantly reduces the risk of unauthorized access.

- How to Enable: To activate 2FA, log into your Exness account, navigate to the account settings, and follow the instructions to set up two-factor authentication. This typically involves scanning a QR code with a mobile authentication app, which will then generate time-sensitive codes to use during the login process.

User Reviews and Testimonials

Client Testimonials

Real customer reviews often highlight the reliability of Exness, the ease of use of its trading platforms, and the effectiveness of customer support. Many traders appreciate the low spreads, fast execution of trades, and the transparency of transactions.

Expert Reviews

Exness is frequently reviewed by industry experts who praise its regulatory compliance and wide range of trading instruments. Experts also commend Exness for its user-friendly interfaces and advanced technological infrastructure, which make it a preferred broker for many traders worldwide.

Pros and Cons

Advantages

- Broad Range of Markets: Offers extensive trading options across forex, cryptocurrencies, metals, and more.

- Advanced Trading Platforms: Provides access to both MT4 and MT5 platforms, which are highly regarded for their reliability and range of features.

- Competitive Conditions: Known for its tight spreads, no hidden commissions, and flexible leverage, which cater to all types of traders.

- Strong Regulatory Framework: Regulated by several reputable authorities, ensuring high levels of security and fairness.

Disadvantages

- Limited Product Portfolio in Some Regions: While Exness offers a wide range of instruments globally, the availability of certain products like CFDs on stocks might be limited in some regions.

- Customer Support: Although generally well-reviewed, some users have mentioned delays during peak times, which could be improved for even better customer service.

Frequently Asked Questions (FAQs) at Exness

How do I open an account with Exness?

Opening an account with Exness is straightforward. Visit the Exness website, click on ‘Open an Account’, and fill in the required personal information. After completing the registration, you will need to verify your identity to comply with financial regulations before you can start trading.